File Income Tax Return Online in India for Free in 10 Minutes

In this tutorial we will see, how to file your IT Returns online in just 10 minutes. It's very easy task even for a layman. There are lots of benefits to file income tax return online. No need to stand in long queues at the income tax department, no need to pay to a broker, no fear of losing any document, and last feeling of self satisfaction :)

In this tutorial we will see, how to file your IT Returns online in just 10 minutes. It's very easy task even for a layman. There are lots of benefits to file income tax return online. No need to stand in long queues at the income tax department, no need to pay to a broker, no fear of losing any document, and last feeling of self satisfaction :)Why Filing ITR is Important

- If you are expecting any refund of tax, unless you file the return, you will not get your refund.

- If you have some other source of income in addition to salary (such as rent, interest, capital gains etc. not disclosed in form 16), and if you do not file your return, this can be treated as undisclosed income and liable to tax, interest and penalty from tax department.

- It is mandatory for certain set of people to file their return irrespective of their tax status (eg. Owner of immovable property, 4 wheeler, credit card etc.)

- IT return is an important financial document which many banks ask for while applying for loan etc.

What will happen if you don’t file ITR

- If you are expecting a refund, you will not get the same

- If you fall under the set of people for whom filing is necessary or if you have any other source of income, the tax department can impose interest/penalties.

Steps to eFile ITR:

(1) Open official site for filing income tax in India (incometaxindiaefiling.gov.in)

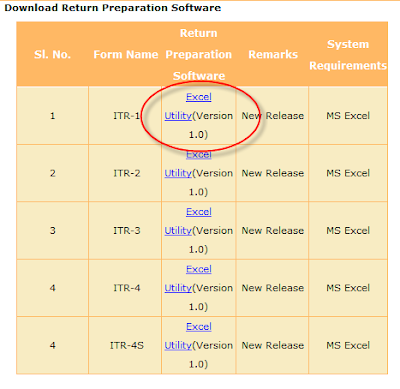

(2) Navigate to Download > e-Filing A.Y. 2011-12 > Individual, HUF

(3) Go down the page and download excel utility (ITR-1)

(4) Extract the file to a folder ( This is important ). Open the file and enable macros.

(4) Extract the file to a folder ( This is important ). Open the file and enable macros. (5) Fill all the details which are mentioned in the excel using form 16 provided by your company. If you face any problem in filling these fields, just drop in a comment or check the next section.

(5) Fill all the details which are mentioned in the excel using form 16 provided by your company. If you face any problem in filling these fields, just drop in a comment or check the next section.Don't forget to mention if you want IT returns in form of cheque or via account transfer. If you choose account transfer, you will need MICR code for the branch. You can find the same @ http://rbidocs.rbi.org.in/rdocs/content/docs/67440.xls

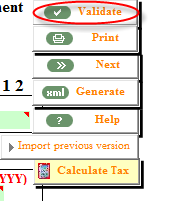

(6) After filling all the details on each page, click Validate on each page to validate the entries. This will validate all entries and will let you know if you forgot to fill some. Now click on Calculate Tax.

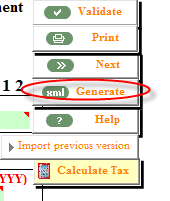

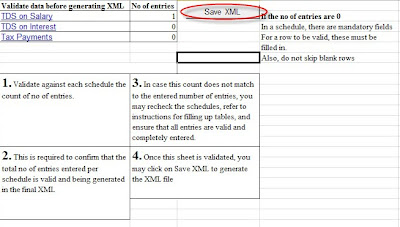

(7) Click on Generate XML. This will generate an XML file at same location as that of excel file.

(7) Click on Generate XML. This will generate an XML file at same location as that of excel file.

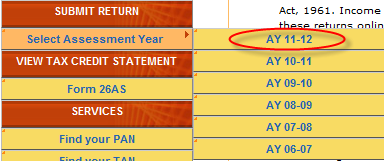

(8) Now go back to the site for filing income tax and navigate to Submit Return > Select assessment year > AY 11-12.

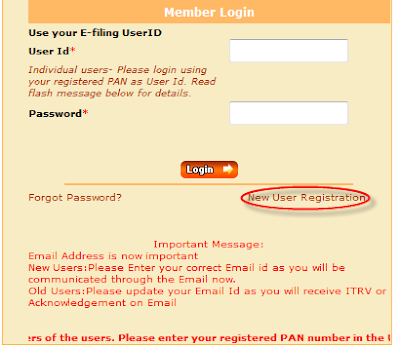

(9) Register for an account with appropriate details, providing your PAN card.

(9) Register for an account with appropriate details, providing your PAN card. (10) After registering again navigate to Submit Return > Select assessment year > AY 11-12 and login with the same credentials.

(10) After registering again navigate to Submit Return > Select assessment year > AY 11-12 and login with the same credentials.(11) In 'Select form name', select ITR-1 and click on next.

(12) Upload the XML file generated earlier.

(13) Instantly your ITR-V form is generated (sometimes the ITR-V form will not be mailed to you, so please save the ITR-V form which is generated on the screen).

(14) Take two prints of ITR-V form. You can obviously use free office printers :)

(15) Send the ITR-V form on the address mentioned above the ITR V form within 120 days of uploading the XML. Use only normal post.

(16) After IT department receive the duly signed ITR V and verify it, they will send you the acknowledgment mail to your mail-id. This will complete the whole process.

This acknowledgment mail is important, so keep it with you along with ITR V form.

Enjoy!!! Your tax filing is done in not more than 10 minutes and in only Rs. 5 ( Postal Cost )

Points to Remember

- Income Tax Ward / Circle field in excel is not required.

- Return filed under section field in excel , don't change the default value.

- Gross Total Income (1+2c) field in excel , this you can get in Form 16 mentioned as 'Income under the head salaries'

- Sign here field in excel is not required, leave it as it is.

- Did more investment than mentioned in form 16? Mention those additional investment + investment already highlighted in Form 16. No need to submit any proofs for investment.

- All other required fields, you can find in Form 16 easily.

- Change the field 'Whether original or revised return' to 'R-Revised'

- Provide the acknowledgment number of the previous ITR-V and mention the date of the first ITRV generation.

- Also change the 'Returned files under section' filed to the last option in the drop down i.e. '16-u/s 139(5)'

Only one of the below can be claimed by an individual

Home Loan Exemption

1) Already occupied flat/house

- Interest goes in as –ve in the “Income from house property”

- Principal goes in as +ve amount in Section 80 C (should be within the 1 lakh cap)

- Do nothing, sit quietly and feel jealous/angry (as am feeling now)

- Once possession is done, can apply 20% of Interest and Principal for a period of 5 years for all the years gone by.

- Ex; EMI started already since 2010 but possession in Jan 2012 – then while filing returns next year, can apply for entire 2011-2012 EMI + 20% of whatever paid in 2010-2011 tax year.

- Next year 20% again and so on for a total of 5 years.

Amount of deduction: Least of the following is deductible u/s 80GG

- HRA received.

- House rent paid in excess of 10% of salary

- 50 % of salary if rented house is situated in Mumbai ,Chennai, Kolkata, Delhi. In any other city - 40 % of salary

1) Actual HRA received : 39,000

2) Annual rent – 10%(basic + da) – say the rent is 13k and 10% of annual salary (basic and DA) is 6885 -> (13000*12) – (6885) : 58,115

3) 40% of salary – if in HYD : Say it is 27,540

So the minimum of a, b, c is 27,540.

This amount goes in the Section 80 GG of your deductions. However, the cap by IT is 24000 and system automatically calculates the amount to 24000 anyway.

Conditions for exemption from filing tax returns

As per the bill issued by the government, no individual will be required to file tax returns for the financial year 10-11 if his income does not exceed Rs. 5 lakh. However, one should file returns beacuse it helps in long run.

Here are the clauses which has to be followed in order to avail the above mentioned policy.

- Total income after allowable deductions is up to Rs 5 lakh.

- Income is only from salary and savings bank interest.

- Salary is from one employer.

- Savings bank interest is below Rs 10,000

- Tax due on savings bank interest has been paid and included in Form 16

Some people have reported that they are not able to file ITR online because the system says that name entered by them does not match with their records. This is due to the discrepancy in thier record. Follow the steps below to bypass this issue :

- Go to https://onlineservices.tin.nsdl.com/etaxnew/tdsnontds.jsp. This is the site to make online payment to the tax dept.

- Select 'Challan No. /ITNS 280'

- Enter your PAN and other mandatory details and click 'Proceed'.

- The screen that comes next will ask you to verify if the name corresponds to the PAN no.

- Here's where you will see some discrepancy that the tax dept. database has regarding your name.

- Go to url: https://incometaxindiaefiling.gov.in/portal/knowpan.do

- Enter the first name, middle name, surname and DOB (here enter the surname which is retrieved from above process), if u r able to get your pan number without any difficulty surely you won’t face any problem for registering with those details.

Filing ITR using 2 Form-16 forms ( Previous Employer and Current Employer )

In some cases a person might have 2 Form 16, one from previous employer and second from current employer. In such a case, follow the steps below :

- In the 1st page of the ITR 1 Excel, will have put in a sum of income (from 2 companies) and deductions.

- In the 2nd worksheet, TDS sheet, you have provision for entering multiple companies, income from the same and tax paid. So you will have 2 rows for 2 companies.

- Make sure that the sum of the amounts entered in the 2nd worksheet is same as that of the total entered in the 1st page.

- “There is no need to file income tax returns if tax is already deducted by employer” This is not true. Even though tax has been deducted you need to file your income tax return. Form 16 received from the employer is not the income tax return.

- “Since I do not receive much Interest on my SB account. I can ignore it” The Interest earned on savings bank account is taxable.

- “Omission of income received by a minor child.” A minor child is not required to file a separate return. However, this income has to be included with either of the parents.

- “For the rent I pay I get equal amount of HRA exemption”. This is not true; the exemption is lower of: (i) H R A given by the employer, (ii) 40% (50% in case of metro) of Basic Pay + DA (iii) or, actual rent paid minus 10% of your Basic Pay + DA. Thus if actual rent paid is lower than 10% of your basic salary you receive no exemption.

- “Everyone having PAN requires to file returns” This is not correct, you need to file your tax return only if your income is above taxable limit.

- “I can avoid giving my email-id, communication address and bank details” one should make sure you have provided a valid and functional email address. You are also required to update your bank account details even though there is no refund.

- “I cannot claim the TDS, unless I have a TDS certificate” False, With the introduction of FORM 26AS, you can view the TDS deducted by your deductor and claim.

- “I will have to submit form 16 and all other the relevant documents along with the return” The return forms are annexure less. Hence no documents need to be attached. Even if you are claiming deductions which are not considered in the form 16

- “I do not have to disclose income which is exempt from tax” Even if you have income which is exempt from tax you are required to disclose it in your return.

Facing any issues ? Just drop in a comment for a solution :)

TechQuark is a mobile-friendly website. Simply bookmark

TechQuark is a mobile-friendly website. Simply bookmark